How to Conduct Market Research That Gets Results

Published

Let's face it: making a big business decision without data is just a high-stakes guess. To really get market research right, you need a clear process. It starts with figuring out exactly what you need to know, then picking the best tools for the job—like surveys or one-on-one interviews. After that, it’s all about gathering the data and, most importantly, digging through it to find those golden nuggets of insight.

Think of this guide as your playbook for shifting from pure guesswork to a data-backed strategy.

Your Starting Point for Effective Market Research

Honestly, without solid data, your next big move is just a shot in the dark. This guide is here to pull back the curtain on the process that top companies use to genuinely understand their customers, get ahead of trends, and stay on top. We're skipping the dusty, old-school methods and jumping straight into a modern toolkit packed with AI-powered analytics, social listening, and smarter survey tactics.

This isn't some abstract, academic exercise. It's a practical roadmap designed to make research feel less intimidating and, crucially, something you can actually use. Whether you're a startup founder trying to see if your idea has legs or a digital marketer tweaking a campaign, the core principles are exactly the same.

Why Market Research Matters Now More Than Ever

Gut feelings and old assumptions just don't cut it anymore. The demand for reliable, accurate data has skyrocketed because businesses are leaning on deep market insights to shape everything from new product features to which influencers they partner with.

This growing reliance on data is driving massive growth. The global market research industry is on track to hit around $150 billion by 2025, which really shows how vital it's become. This isn't just a niche field; it's a fundamental part of how smart businesses operate. If you're curious, you can find more insights about market research industry trends and their impact.

The whole point of market research isn't just to hoard data; it's to reduce uncertainty. Every single data point should get you one step closer to making a confident decision, whether that's launching a new service or picking the perfect creator for a campaign.

What You Will Learn in This Guide

I’ve broken down the entire process into easy-to-follow stages. You'll get a bird's-eye view of what’s ahead, so you can build a research plan that truly fits your goals and budget.

Here’s what we’ll cover:

- Defining What You Need to Know: I'll show you how to turn those broad, vague business questions into sharp, focused research objectives that actually give you clear answers.

- Choosing the Right Tools: We’ll walk through the best methods out there, from quick online surveys to deep-dive interviews, so you can pick the right approach for what you're trying to achieve.

- Executing Flawlessly: You'll get hands-on advice for collecting high-quality, unbiased data. After all, your insights are only as good as the information you start with.

- Turning Data into Action: This is the most important part. We’ll cover how to translate all those raw numbers and quotes into a real strategic advantage for your next big move.

Defining Your Research Goals and Objectives

Before you even think about writing a survey or digging into a competitor’s social media, you have to know what you’re looking for. Seriously. Diving into research without a clear direction is a surefire way to burn through your budget and end up with a pile of data that doesn’t tell you anything useful.

Think of it this way: your research objectives are the foundation of the entire project. Get this part right, and everything that follows—from the questions you ask to the data you collect—will be focused and purposeful.

A goal like "learn more about our audience" is a classic trap. It sounds productive, but it’s far too vague to lead anywhere meaningful. You need to sharpen that fuzzy business problem into a specific, answerable question.

For instance, instead of that broad goal, a far more effective objective would be: "Identify the top three friction points that cause users to abandon their cart in our mobile app." See the difference? This question is precise, measurable, and directly tied to a business outcome—improving conversions. It gives your research a clear mission.

From Vague Problems to Specific Questions

The real skill here is translating big-picture business challenges into questions that data can actually answer. What decisions are on the line? What problems are you trying to solve? Maybe you're launching a new product, or perhaps you're trying to figure out why a competitor is suddenly pulling ahead. This process forces you to pinpoint the exact knowledge gaps holding you back.

Here’s what that transformation looks like in practice:

The Vague Problem: "Our new influencer campaign isn't performing well."

The Specific Objective: "Determine if our chosen influencers' audiences align with our target customer profile and identify any messaging disconnects in their content."

The Vague Problem: "We need to grow our market share."

The Specific Objective: "Analyze our top three competitors' social media strategies to identify an underserved audience segment we can target." A solid competitive analysis framework is your best friend here, giving structure to your investigation.

The sharper your question, the clearer your answer will be. A well-defined objective acts as a filter, helping you ignore irrelevant data and focus only on the information that will help you make a better decision.

Making Your Objectives SMART

To make sure your goals are truly solid, run them through the SMART framework. This isn't just another piece of business jargon; it's a practical checklist to ensure your research has a real purpose and a measurable outcome.

Your objectives need to be:

- Specific: Clearly state what you want to achieve. Who are you studying? What information do you need?

- Measurable: How will you measure success? Is it a percentage increase, a specific number, or a list of identified themes?

- Achievable: Be honest about what you can accomplish with your time, budget, and team.

- Relevant: Does this research directly support a larger business goal? How will this actually help the company?

- Time-bound: Give yourself a deadline. When does the research need to be done?

Let’s put this into a real-world scenario. Imagine an influencer marketing agency struggling with client retention. A fuzzy, non-SMART goal would be: "Find out why clients leave."

Now, let's sharpen it using the SMART framework:

"We will conduct confidential exit interviews with all clients who churned in Q3 (Specific) to identify the top three most-cited reasons for discontinuing our service (Measurable). The project is manageable for our current team (Achievable) and will directly inform our new client success protocol for Q4 (Relevant). All analysis will be completed by October 30th (Time-bound)."

That objective is powerful. It tells the team exactly who to talk to, what to find out, and how the results will be put to use. By spending the time upfront to get this level of clarity, you set up every other step of your research for success.

Choosing Your Research Methods and Tools

Alright, with your objectives nailed down, it’s time to pick your tools. The world of market research is vast, and honestly, it can feel a little intimidating. But it really boils down to two main paths: primary and secondary research.

Think of primary research as having a suit custom-tailored. You're gathering brand-new data directly from your audience to answer your specific questions. Secondary research, on the other hand, is like finding a fantastic suit off-the-rack—you're using existing data that someone else already put together.

The strongest strategies almost always blend the two. You might start with secondary data to get the lay of the land, then launch into primary research to get answers that are unique to your brand and campaign.

Primary Research: The "What" vs. The "Why"

When you decide to gather your own intel, you're faced with another big choice: quantitative or qualitative research. Getting this right is the key to unlocking genuinely useful insights instead of just a pile of data.

Quantitative Research (The "What"): This is all about the numbers. It's the hard, measurable data that answers questions like "How many?", "How often?", and "What percentage?". We're talking large-scale surveys, website analytics, and polls. This stuff gives you the statistical confidence to spot broad trends.

Qualitative Research (The "Why"): This is where you get the story behind the numbers. It’s about digging into opinions, feelings, and motivations. Through methods like in-depth interviews, focus groups, and even social listening, you can finally understand why people are behaving a certain way.

I've seen so many projects where a team identifies a problem with quantitative data, but it's the qualitative follow-up that finds the solution. For instance, your analytics might show that 70% of users are abandoning their shopping carts (the what), but it takes a few candid interviews to discover it's because the shipping costs are a nasty surprise at the very end (the why).

A common pitfall is stopping at the quantitative data. Numbers tell you what’s happening, but they almost never tell you why. The real "aha!" moments come when you pair that hard data with real human stories.

Selecting the Right Method for Your Scenario

There’s no magic bullet here. The best method is always the one that fits your specific goals, budget, and timeline. It's worth taking a moment to review the essential types of research methods to get a feel for all the options at your disposal.

Let's walk through a real-world example I see all the time in influencer marketing.

Scenario: You’re launching a new skincare line for Gen Z. You need to know if the messaging for your big influencer campaign will actually land with them or just fall flat.

A So-So Approach: Blasting out a generic survey asking thousands of people, "Do you like this product?" The feedback will be too vague to be of any real use.

A Pro-Level Approach: A smarter, multi-step process. First, you conduct a handful of in-depth interviews with people squarely in your target demographic. Get their raw, unfiltered reactions to the messaging concepts. Then, take what you learned from those conversations to build a sharp, focused online survey to see which message performs best with a much larger group.

This is where knowing your audience inside and out really pays off. A message that resonates with one segment could be a total turn-off for another. For a deeper dive into this, these practical audience segmentation examples are a great resource for seeing this in action.

Comparing Market Research Methods

To help you decide, here’s a quick-glance table breaking down the four main types of market research. Think of this as your cheat sheet for matching the right method to the job at hand.

| Method | Primary Purpose | Common Tools | Best For |

|---|---|---|---|

| Surveys | Gather quantitative data at scale | SurveyMonkey, Google Forms, Typeform | Validating hypotheses, measuring satisfaction, understanding broad preferences. |

| Interviews | Gain deep qualitative insights | Zoom, UserTesting, in-person meetings | Exploring complex topics, understanding motivations, getting detailed user feedback. |

| Focus Groups | Observe group dynamics and discussions | In-person facilities, moderated online forums | Brainstorming ideas, testing ad concepts, understanding group consensus. |

| Observations | Watch user behavior in a natural context | Hotjar, Google Analytics, field studies | Identifying usability issues, understanding purchase behavior, seeing how people use a product. |

As you can see, each method serves a different purpose. The key is to be strategic, sometimes even combining methods to get a complete picture of the market.

Powerful—and Accessible—Research Tools

The great news? You don't need a massive budget or a dedicated research department anymore. The global market research industry exploded to over $84 billion by 2023, largely because of the incredible tools now available to everyone.

Here are a few of my go-to's that are perfect for influencer and digital marketing pros:

- Online Surveys: Tools like SurveyMonkey or the ever-reliable Google Forms make it simple to get quantitative data from a big audience, fast.

- Social Listening: Platforms like Brand24 or Sprout Social are essential for tracking brand mentions and getting a feel for the qualitative sentiment online.

- Website Analytics: You can't beat Google Analytics for the numbers, but pairing it with a tool like Hotjar gives you heatmaps and recordings to see why users are dropping off.

- Trend Analysis: I use Google Trends and Exploding Topics constantly to track interest in specific topics, brands, or even potential influencers over time.

For most people just starting out, an online survey is the perfect entry point. It's straightforward, affordable, and gives you a solid foundation of data to work from.

Platforms like these have made building a professional-looking survey incredibly easy, letting you focus your energy on what really matters: asking the right questions.

Executing Your Data Collection Plan

Alright, you’ve got a solid plan. Now it’s time to get your hands dirty and actually collect the data. This is where the rubber meets the road, and even the most brilliant research design can fall apart if the execution is sloppy.

The goal isn't just to gather a pile of information; it's to gather clean, trustworthy data. Every piece of information you collect needs to be solid. This part of the process is all about being meticulous—how you ask questions, who you talk to, and how you record what they say. It’s a bit of a science and an art.

Mastering Primary Data Collection

When you're collecting primary data, its quality is entirely on you. Whether you’re fielding a survey or sitting down for one-on-one interviews, the small details of your execution will make or break the final results.

With surveys, the most common trap is asking biased questions. A leading question like, "How much do you love our new feature?" is designed to get you a pat on the back, not real feedback. A much better, more neutral approach is: "How would you rate your experience with our new feature on a scale of 1 to 5?"

Finding the right participants is just as critical. A perfectly worded survey answered by the wrong audience is completely useless. Use screener questions at the very beginning to filter out anyone who doesn't fit your target persona.

Your data is only as good as its source. Poorly recruited participants for a survey or interview will lead you to a false conclusion just as quickly as a poorly written question.

Getting Genuine Insights from Interviews

Interviews are where you get to the "why" behind the data, but that only happens if you create a space where people feel safe enough to be honest. Most people naturally want to be agreeable, so it's your job to gently dig past the polite, surface-level answers.

When you're in the thick of qualitative research like interviews, applying effective note-taking methods is a game-changer. Great notes capture the nuances, direct quotes, and subtle reactions that will bring your analysis to life later on.

Here are a few of my favorite techniques to get people to open up:

- Ask Open-Ended Questions: Instead of asking, "Was the checkout process easy?" try, "Can you walk me through how you completed your purchase?" This prompts a story, not just a yes or no.

- Embrace the Awkward Silence: This one feels weird at first, but it works. When someone finishes a thought, just wait a few extra seconds before you jump in. They will often fill that silence with deeper, unprompted insights. That's where the gold is.

- Use Their Language: Listen closely to the specific words they use. If a participant says the app felt "clunky," mirror that word back in a follow-up question: "Tell me a little more about what felt 'clunky' to you." It shows you’re actively listening and builds incredible rapport.

The Art of Ethical Secondary Research

Secondary research means you’re working with data that already exists—think industry reports, government stats, or competitor deep dives. It's a fantastic way to get the lay of the land without the expense of a massive primary study. But be warned: the internet is a minefield of bad information.

Your main job here is to be a ruthless critic. Always, always check the source. A report from a heavyweight analyst firm like Gartner or Forrester is worth a lot more than an unsourced blog post. Government data from places like the U.S. Census Bureau is often a goldmine for demographic info.

As you evaluate secondary data, keep these three things in mind:

- Check the Publication Date: Is the report from last year or a decade ago? Markets, especially in the digital space, change fast. Newer is almost always better.

- Understand the Original Purpose: Why was this data collected in the first place? A study funded by a company trying to sell its own product likely has some built-in biases you need to account for.

- Look for Corroboration: Can you find another credible source that backs up the claim? If two or three reputable sources are reporting similar findings, you can feel much more confident in the information.

Pulling off a great data collection plan comes down to discipline and an eye for detail. By carefully crafting your questions, finding the right people, and being a critical consumer of existing data, you build a foundation of rock-solid information—the raw material for insights that actually drive business decisions.

Turning Data Into Actionable Insights

So, you've gathered all this data. That's a great start, but it's just raw material. The real magic happens when you start finding the story hidden inside all those numbers and quotes. Until you analyze it, raw data is just noise. This is where your hard work really begins to pay off, turning what you've observed into real, strategic actions.

The market research industry has absolutely exploded, ballooning from $71.5 billion in 2016 to a projected $140 billion in 2024. Why? Because businesses that can translate messy data into a clear game plan are the ones that win.

Uncovering Trends in Your Quantitative Data

When you're staring at a spreadsheet full of survey results, it's tempting to stop at the surface-level percentages. But the real power is in spotting the trends and connections hiding just beneath. You don't always need fancy software for this; honestly, a tool as simple as Google Sheets can be your best friend for connecting the dots.

Don't just report that 65% of respondents liked a new feature. Go deeper. Slice up your data and see how that number changes when you look at different groups of people.

- Does that approval rating suddenly jump to 85% for users under 30?

- What if it plummets to 40% among customers who’ve been with you for over a year?

These comparisons start to tell a much more interesting story. When you're pulling from different data sources, things can get complicated, so it's worth looking into tips for overcoming data integration challenges. Finding these patterns is how a simple statistic becomes a powerful insight into who your feature is really working for.

Finding Themes in Qualitative Feedback

Qualitative data from interviews or social media comments can feel like a tangled mess. But this is where you find the rich, human context that numbers alone will never give you. The trick is to organize it all through thematic analysis—a simple but incredibly effective way to group similar comments and uncover what truly motivates your customers.

Your first step is to just read through everything. As you do, start highlighting recurring ideas, frustrations, and happy moments. Then, you can start clumping those highlights into broader themes.

Real-World Example

Let's say you just wrapped up five interviews about your app's onboarding. As you're going through your notes, you might spot a few things:

- Three different people said they felt "overwhelmed" by all the pop-ups.

- Two others mentioned they "couldn't find the main dashboard" at first.

- Four of them were annoyed they had to "enter payment info too early."

Suddenly, clear themes are jumping out: Initial Overwhelm, Navigation Confusion, and Premature Monetization. You’ve just turned a random list of complaints into a structured set of problems you can actually solve.

The goal of analysis is to elevate your findings from a simple observation to a strategic insight. It’s the critical link between "what" is happening and "why" it matters for your business.

From Observation to Actionable Insight

Here’s a distinction that matters: an observation is just a statement of fact. An insight, on the other hand, connects that fact to a "why" and points to a clear "what's next." This is the key to getting stakeholders to listen and, more importantly, act.

Here’s how to frame your findings to make them more powerful:

| From Observation (The "What") | To Actionable Insight (The "Why" and "So What") |

|---|---|

| "55% of users dropped off on the pricing page." | "Users are dropping off because the pricing tiers are confusing and don't clearly state the value, causing them to lose confidence before committing." |

| "Our new influencer campaign got 10,000 likes." | "The campaign resonated strongly with a younger demographic (18-24), indicating our new messaging is effective for this segment and should be amplified in future efforts." |

| "Customers rarely use the 'Advanced Reports' feature." | "Our core users feel intimidated by the 'Advanced Reports' feature, suggesting we need to simplify the interface or provide better in-app guidance to increase adoption." |

When you communicate this way, you stop being just a data reporter and become a strategic advisor. You shift the conversation from what happened to what we should do about it. For a closer look at connecting data to business outcomes, check out our guide on how to measure marketing effectiveness. A simple report that highlights these key insights—backed by a few choice quotes and data points—is the best way to get people moving and prove the real value of your work.

Common Questions (and Straight Answers) About Market Research

Even the most buttoned-up research plan will have you asking questions along the way. Let's tackle some of the most common ones that pop up when you're getting your hands dirty with market research.

So, What's This Actually Going to Cost Me?

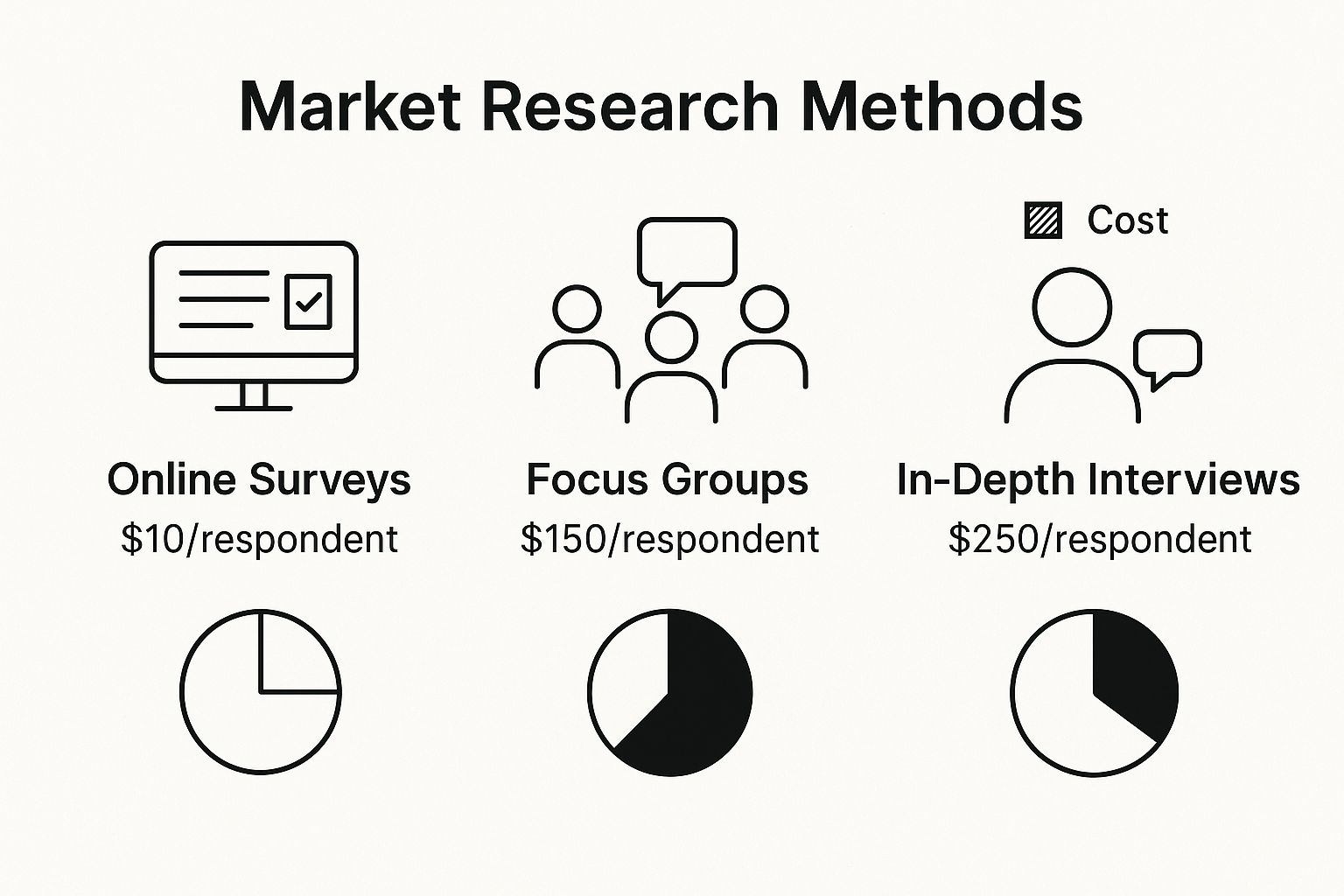

This is always the first question, isn't it? The honest answer is: it depends entirely on how deep you need to go.

On the super-scrappy end, you can get a lot done for free. Digging into existing reports and government data (secondary research) just costs you time. Firing off a survey to your email list using something like Google Forms is also practically free.

But if you need to hear from people outside your own bubble, costs start to creep in. Using a survey panel to get 1,000 responses might run you anywhere from a few hundred to several thousand dollars. And if you want to sit down and really talk to people? Qualitative methods like focus groups or one-on-one interviews are the most expensive, easily costing thousands once you factor in recruiting the right people, paying them for their time, and moderating the sessions.

It’s not about finding the cheapest path. The real goal is to match your method to your budget and how much certainty you need. Sometimes, five deep conversations with real customers are worth more than a massive, unfocused survey.

Market Research vs. User Research—Aren't They the Same Thing?

It’s an easy mistake to make. They're related, but they solve different problems. Think of it as the difference between a telescope and a microscope.

Market research is the telescope. It gives you that wide, panoramic view of the entire industry. You’re looking at competitors, market size, and broad customer trends. It helps you answer big-picture questions like, "Is there even a market for this idea?"

User research (or UX research) is the microscope. It zooms all the way in on a single person interacting with your product or service. This is where you figure out why people are getting stuck on your checkout page or how they actually use that new feature you built.

Market research tells you if you should build the car. User research tells you where to put the cup holders.

How Can a Small Business Do Research Without a Big Budget?

You absolutely don't need a massive budget to get smart. You just have to be scrappy and resourceful. Forget about statistical perfection and focus on getting good, directional feedback to make your next move smarter.

Here’s how you can start:

- Become a Data Detective: Start with secondary research. This is your best friend. Get lost in government data, read every trade publication in your niche, and analyze your competitors' social media comments. Tools like Google Trends are free and incredibly powerful for spotting what people are searching for.

- Talk to Your Fans: You already have a focus group waiting for you—your existing customers and followers. Send a simple survey to your email list. The people who already like you are usually more than willing to tell you what they think.

- Keep it Casual: Forget formal focus groups. Just schedule 20-minute Zoom calls with five of your most loyal customers. Ask them what they love, what drives them crazy, and what they wish you'd do differently. Their unfiltered feedback is pure gold.

How Long Does a Market Research Project Usually Take?

The timeline can be anything from a frantic week to a slow-burn quarter. It all comes down to the complexity of your questions and the methods you're using.

A quick-and-dirty online survey? You can probably go from idea to analysis in a week or two.

But a multi-stage, comprehensive study is a different beast entirely. If you're starting with in-depth interviews to shape your questions and then following that up with a large-scale quantitative survey, you could easily be looking at three months from start to finish. The biggest variables are always your goals and how hard it is to find the right people to participate.

Ready to find your next big role in the industry you love? At Influencer Marketing Jobs, we connect talented professionals with top opportunities in social media, content strategy, and brand partnerships. Explore the latest full-time, remote, and freelance positions today at https://influencermarketingjobs.net.